This tax time, the ATO is ramping up its data-matching program and capabilities with two new programs.

Taxpayers beware, this tax time, the ATO will be using all its data matching capabilities in multiple areas to ensure that individuals are paying the correct amount of tax. In addition to the previously announced data-matching program on residential investment property loans, on 5 June 2023, the ATO also announced the commencement of a new landlord insurance data-matching program.

The landlord insurance data-matching program will collect landlord insurance data from insurance companies and their subsidiaries. Some 48 insurers of varying sizes will be a part of the program and data from the 2021-22 to 2025-26 income tax years will be collected.

Specific data items will include the following:

- identification details such as names, addresses, phone numbers, dates of birth, bank account details, etc;

- insurance policy details including policy numbers, policy details, insured property details, insurance premiums paid, claims information (eg payouts received), etc.

The ATO estimates that records relating to around 1.6m individuals will be obtained each financial year. The data obtained will be matched with ATO records to support the identification, assessment and treatment of rental property income, expenses and CGT risks. For example, the ATO will be comparing the landlord insurance data with information taxpayer reports in their rental property schedules and rental tax return labels.

Another new data-matching program notified on the same day as the landlord insurance data-matching program is the income protection insurance data-matching program. This seeks to obtain income protection insurance policy data from Zurich Australia Ltd, TAL Life Ltd, Resolution Life Ltd, MLC Ltd, AIA Australia Ltd, and ClearView Life Assurance Ltd for the 2021-22 to 2025-26 income years.

Data items collected will include:

- policy owner details – names, addresses, phone numbers, dates of birth, bank account details, ABNs if applicable, etc. insured person identification details for individuals – names, addresses, phone numbers, dates of birth, bank account details, ABNs if applicable, etc. policy details – policy name, type, brand, start/end dates, premiums, payouts (including proportion of payouts relating to income replacement), etc.

According to the ATO, the income protection insurance data-matching program has been commenced as a result of sampling work conducted in 2021. It found that most individuals with a claim incorrectly reported the relevant assessable income in their tax return, some omitting the payment completely. In addition, most individuals also incorrectly claimed their deduction premium towards an income protection policy.

The data obtained under this program will be used to identify and educate individuals to correctly report assessable income from an income protection insurance claim at label 1 (salary and wages) or label 24 (other income) in their returns, and also correctly report deductible premiums paid towards an income protection policy at label D15 (other deductions).

It is estimated that approximately 1.9m individuals will be affected. In addition to the already announced data-matching programs, the ATO also reminds taxpayers that the sharing economy reporting regime is set to commence from 1 July 2023. This regime will require more electric distribution platforms to report payment information to the ATO including taxi-services, ride-sourcing, and short-term accommodation, with all other electric distribution platforms reporting information from 1 July 2024.

As the cost of living crisis starts to bite, and many taxpayers are supplementing income with work in the sharing economy, the data obtained under the regime is sure to be a focal area for the ATO going forward.

Tax time is just around the corner; we know it can feel overwhelming. But don’t worry; we’ve got your back! ????????

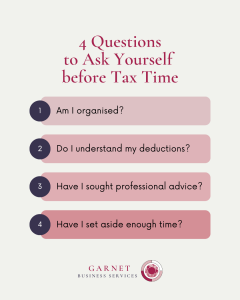

Before diving into those numbers, take a moment to reflect on your confidence level. Ask yourself these four essential questions to boost your confidence and make tax season a breeze! ????????

1️⃣ Am I organised?

Take stock of your documents, receipts, and financial records. Having everything in order will make the process much smoother. ????????

2️⃣ Do I understand my deductions?

Educate yourself on potential deductions and credits that apply to your situation. Maximising deductions can make a significant difference in your tax liability. ????????

3️⃣ Have I sought professional advice?

Don’t hesitate to consult with a tax professional or accountant. (That’s us ☺️) This expertise can help you navigate complex tax laws and ensure you’re making the most of your situation. ????????????

4️⃣ Have I set aside enough time?

Rushing through your taxes can lead to costly mistakes. Block off ample time to focus solely on your tax preparation, minimising stress and increasing accuracy. ????⏰

Remember, feeling confident about your taxes is essential; these questions will help you stay on top of things. Let’s conquer tax season together! ????????

If you’re unsure about your personal or business situation and would like some support and guidance, please reach out.

Email reception@garnetaccounting.com.au or click to book an appointment below.